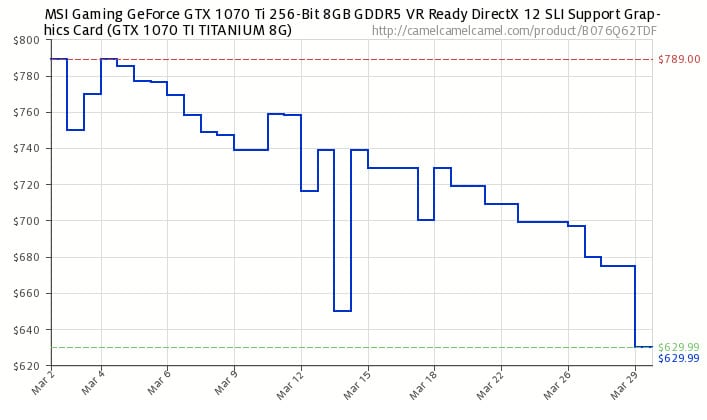

It would be inaccurate to argue that cryptocurrency miners have cornered the market for graphics processing units (GPUs). High GPU pricing has resulted from the basic economics of supply and demand, which may seem oversimplified. As a result of the epidemic, there has been a significant decrease in the availability of silicon semiconductors, which has a knock-on effect on consumer electronics like vehicle game consoles, smartphones, and graphics processing units. NVIDIA and AMD’s introduction of next-gen graphics cards in 2020 piqued players’ interest in playing their favorite games at 4K and sometimes even 8K quality. As a consequence, demand skyrocketed as gamers rushed to replace their aging graphics cards with cutting-edge models. To make matters worse, the epidemic also affected people’s passions and pastimes, shifting more and more individuals into video games. Since everything from classes to payroll was moving online, it only made it natural to keep up with friends via virtual means. It would be possible for me to go on and on discussing the many causes that either boosted demand or lower supply, but I believe I have already proven my argument. Since the debut of the NVIDIA 30 family in the fourth quarter of 2020, GPU costs have been steadily rising. They’re returning to more typical levels now.

Should I buy a used card?

Can’t say that is true. Although previous bids for an RTX 3080 reached up to $80,000, current pricing is far more reasonable. Refurbished NVIDIA 30 series cards should be available for the same price or less than their MSRP counterparts, however, new ones could be harder to come across. Most consumers shopping for a secondhand video card aren’t interested in the product’s previous life as a gaming as well as a 3D rendering rig; rather, they want to know whether the card has ever been used to mine cryptocurrencies. Have You Read: Industry Leading PHP Frameworks To Try In 2022 Cryptocurrency mining is, at least conceptually, not unlike engaging in visually intense entertainment. If GPU availability is also considered, however, there is a substantial difference between the two. Even if a videogame were left on for 24 hours straight, it probably wouldn’t be at its most graphically intensive setting. However, mining cryptocurrencies would push your GPU to labor, and if you’re hoping to amass any kind of respectable return, it’ll have to keep working hard for a very long time, if not forever.

Time is a factor that has been overlooked thus far. Of course, the price of GPUs will fluctuate; however, I believe that in the near future, we can remain optimistic and forecast that costs will drop significantly. Then you should probably hold off, right? Which option is better depends on how much use you can anticipate getting out of buying it early at a higher price. Maybe you don’t have to worry about balancing your time with classes, work, or other commitments. It may be more worthwhile to spend an additional $50 or $100 on a Graphics card now when you have time to make use of it than to save money and buy a GPU within a few months when you will be swamped with college work.